MDW Capital completes a busy H1 2025

London, 9th July 2025

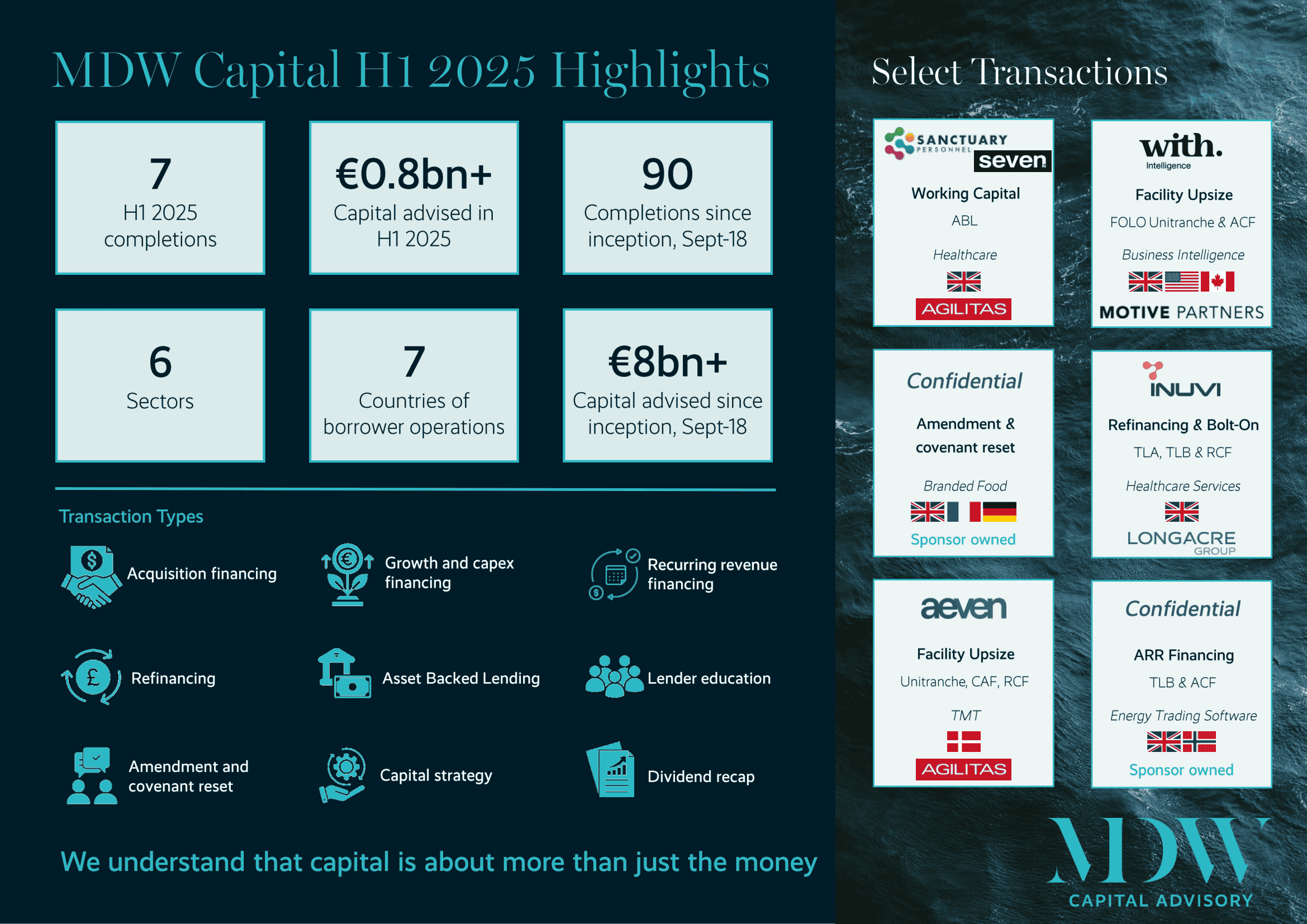

Despite the latest global economic turmoil and uncertainty in the first half of 2025, MDW Capital has continued consistently to complete financings and advise clients on their capital needs. In the six months to June 2025, the Firm has advised six different sponsors and closed seven very different transactions. With deals nearing completion as well as new mandates being won, the second half of the year has commenced strongly.

Key highlights for the Firm in 2025 include:

- Completing seven transactions with debt facilities of c. €0.8 billion across six sectors and seven countries of borrower operations

- Closing the firm’s 90th transaction, taking the Firm’s total capital advised since launching in September 2018 to over €8 billion

- Welcoming an additional team member to the Firm, taking MDW Capital to a team of seven

Andrew Aylwin and David Culpan, Managing Partners of MDW Capital commented “As the Firm grows one thing remains at the Firm’s absolute core: providing best in class advice delivered by a team with its roots in private equity. Year on year, the deep understanding of and ability to think like investors is fundamental to the advice we provide that matches our clients’ needs. It underpins the Firm’s continuing strong performance no matter what the economic backdrop. It has been our privilege to work with exceptionally talented teams, both at companies, their shareholders and capital investors. Huge thanks to all our clients and stakeholders for their fantastic support and encouragement as we continue to grow MDW Capital’s business.”

Contact details:

| Andrew Aylwin

M: +44 777 177 3411 |

David Culpan

M: +44 7734 388 762 |

Jacco Brouwer

M: +44 7561 805 501 |

About MDW Capital

MDW Capital provides specialist capital advisory services to companies and their shareholders. Primarily focused on the European market, and with a greater global reach when needed, MDW Capital’s mission is to solve clients’ capital challenges, using the team’s deep experience and relationships gained from raising in excess of €15 billion of capital, in more than 235 transactions across Europe, the US and the Far East, from over 75 lenders and more than 40 institutional investors.

The partners’ background as investors, lenders and borrowers brings a new perspective to capital advisory. Their background, track record and approach of partnering with companies over a number of years sets MDW Capital apart, whether advising or as a board member, managing or overseeing the long-term relationships with capital providers, or supporting management teams and investors throughout the life of an investment.

Most importantly, MDW understands that capital is about more than just the money.